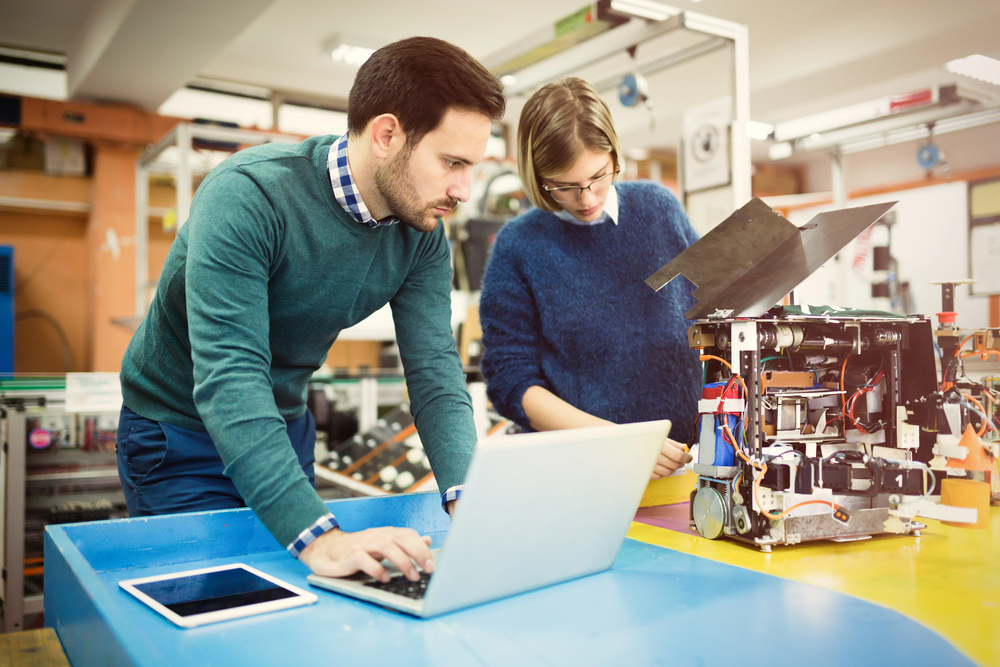

In evaluating the effect of an R&D subsidy we need to know what the subsidized firm would have spent on R&D had it not received the subsidy Using data on Israeli manufacturing firms in the 1990s we find evidence suggesting that the R&D subsidies granted by the Ministry of Industry and Trade stimulated long-run company-financed R&D expenditures: their long-run elasticity with respect to R&D subsidies is 0.22.

At the means of the data, an extra dollar of R&D subsidies increases long-run company-financed R&D expenditures by 41 cents on average (total R&D expenditures increase by 1.41 dollars).

Although the magnitude of this effect is large enough to justify the existence of the subsidy program, it is lower than expected given the dollar-by-dollar matching upon which most subsidized projects are based. This less than full effect reflects two forces: first, subsidies are sometimes granted to projects that would have been undertaken even in the absence of the subsidy and, second, firms adjust their portfolio of R&D projects closing or slowing down non-subsidized projects after the subsidy is received.